So, your not-so-little one’s gotten into University, and now they’re moving away or into halls of residence? What an achievement! Now it’s time to consider what to start planning ahead of the big move! This can be a daunting time for many, and an incredibly emotional one – but this parental survival guide can make the process smoother than butter! Here are the main points to consider when preparing for this new phase in you and your child’s life.

Accommodation

Now your child has accepted their university offer, it’s time to start thinking about setting up a new life for your child elsewhere! Your child’s chosen university will usually have many filter options, including whether they prefer a certain gender when it comes to sharing a flat, or if they’d prefer quieter blocks, if they have a disability and need physical accessibility options, etc…

As well as this, you will most likely be their primary guarantor – the ‘back up’ plan maybe if, for any legal reason, your child cannot make rent. So, make sure to sign all documents and scan all paperwork including your council tax letters, proof of income etc… – as you will need all of this to generate a tenancy for your child. These are things that will need to be applied for sooner rather than later, as you may run out of options and have to go through the clearing process or look at privately renting.

Student Finance

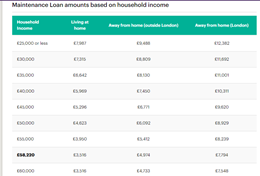

Student finance is calculated rather strangely, as a lot of it is based on what the parents (you) are earning. The more that you earn, the less termly finance your child will get – which is why it is super important that your child is set up well financially.

There are many options to consider when sorting this out. For instance, are you in a position to assist with financial contributions if student loans do not cover rent and bills completely? If so, brilliant! If not, consider encouraging your child to get themselves a part-time job alongside their studies.

If this isn’t doable, there are grants and extenuating circumstances that you can look into. However, it is worth noting, if you are on an annual salary of less than 25K, your child will receive the full student maintenance loan which with good budgeting, is more than feasible to live on. Here is a small chart roughly estimating payments based on parent/guarantor incomes:

Home necessities

It’s also a good time to think about the basic home necessities. Luckily, around August time, supermarkets start to reduce items such as bedding, pots and pans, stationary and so on as they know that student season is approaching. By using this time to your advantage, you’ll get everything you need at a decent price! Here’s a basic checklist of the things you’ll need to prepare for the move:

1. Bedding and duvet covers

2. Kitchenware (cutlery, bowls and plates, utensils)

3. Cookware (pots, pans, utensils, trays)

4. Toiletries and washing products (bleach, antibacterial spray, toilet paper etc)

5. Food shopping

Registering at a new GP

This may seem a tedious one, but if your child is moving out of your home area, or a completely different town or city for Uni, it’s better to be safe than sorry and apply for a new general practitioner, as you never know when the fresher’s flu will hit you! Also, it’s a general legal requirement of you once you move homes outside of your previous area code to do this. It’s a small task, but an essential one to get out of the way early on!

Now that you’ve got your basics covered, why not check out this clever guide to your first tenancy for more great renting tips?